The rise of "contactless ticketing" or "Open Payments" burst onto the scene a few years ago with the roll out of Transport for London’s (TfL) contactless solution, and as a regular user of the system I have to say it works very well, with systems like this being rolled out around the world.

The term "contactless ticketing" has been adopted to refer to the use of contactless bank cards to tap and ride on public transport systems. In this blog post, we'll be focusing on the use of contactless bank cards and these same cards emulated through Apple Pay and Google Pay on mobile for use as a means to simply tap and travel on public transport.

However, it’s worth noting that although these systems are called "contactless" there are many other types of contactless ticketing systems available including Mobile Ticketing and Account-Based Ticketing, using smartcards and mobile barcodes.

What is EMV?

First, the basics. What is EMV? EMV is a technical payments standard that ensures chip-based and contactless payment cards and terminals are compatible (can communicate with each other) around the globe. EMV literally stands for Europay, Mastercard and Visa, the three companies that developed the specifications for the standard. The standard is now maintained by EMVCo which has shared ownership from all the major card schemes.

For years EMV cards have been used for retailing around the globe. The card uses a microprocessor embedded in it that connects to an EMV Point Of Sale unit (POS) via card insertion or a contactless tap, and it's the latter which makes EMV cards interesting for public transport.

What is Contactless EMV (cEMV)?

A contactless payment does not require physical contact between a payment device and a POS terminal/device. The contactless card or mobile device is held near to the PoS terminal (approx less than 2in/6cm away), and the payment account information is encrypted and exchanged during a secure conversation between card and terminal.

Contactless EMV bank cards cards (or cEMV) talk to the PoS unit using NFC (ISO 14443) short range radio, and this is why this type of ticketing is often referred to as "contactless".

What is Apple Pay/Google Pay and How Does This Work with cEMV?

Apple Pay and Google Pay emulate being payment cards through their NFC chips by holding the device near a card reader within a validation device, as you would with a contactless bank card. Both Apple Pay and Google Pay link to a bank card which needs to be set up on their respective services before use. Apple and Google Pay effectively act as the contactless aspect of the process similar to a contactless NFC chip in a contactless bank card.

The 3 cEMV Contactless Ticketing Models:

Transport for London’s contactless ticketing system initially started off as EMV "Model 1" for bus services, but has now progressed into "Model 2" and works because it runs an Account-Based Ticketing (ABT) back office (For more information on ABT click here).

There are three cEMV models, which are defined by the UK Cards Association as:

- Single Tap - fixed price Pay as you Go model (“Model 1”)

- Aggregated - more complex Pay as you Go model (“Model 2” or Mass Transit Transactions (MTT)

- Pre-purchase - tapping the card validates a ticket that has already been purchased (“Model 3”)

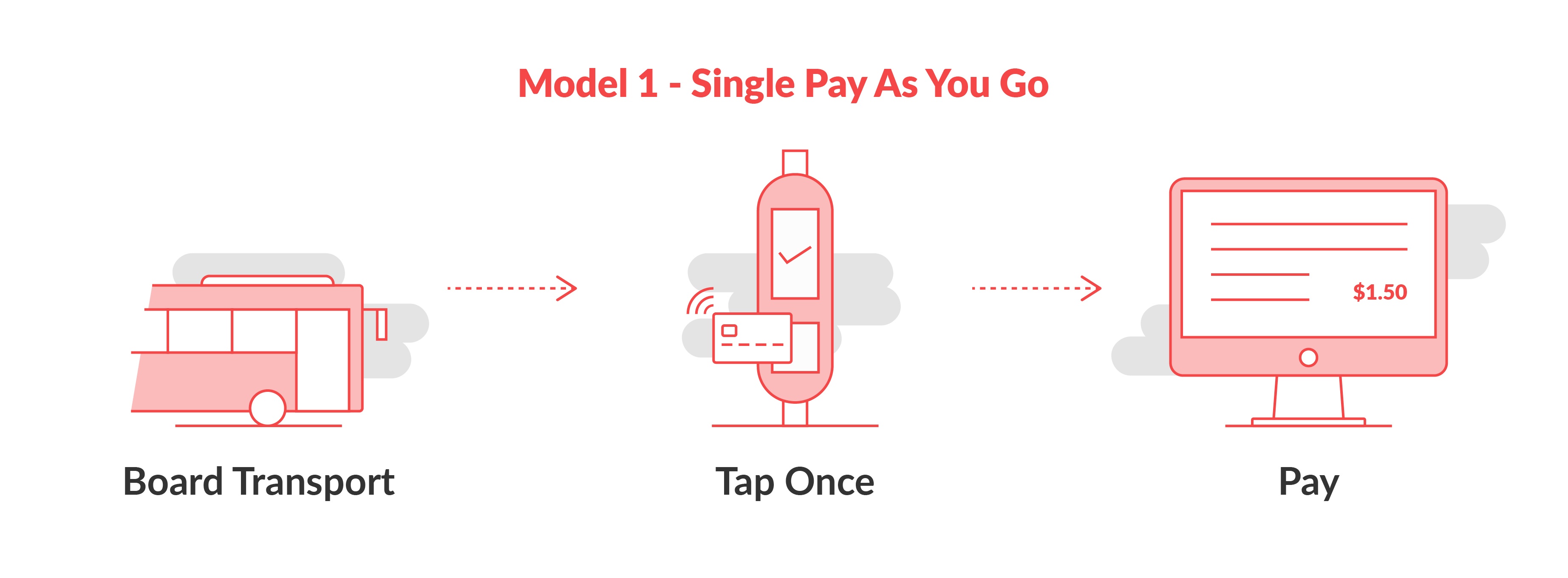

Model 1: Single Tap - Pay as you go Model

In this model the customer taps their card at the start of each journey and a fixed fare is automatically charged. Alternatively the driver can assist in the sale the same way you would purchase something in a shop. This model works particularly well where there is a flat fare and means passengers can move away from cash and the need to buy a ticket, or top up a smartcard.

This model does not require an account-based back-end, because there is no fare calculation to run, and the price charged will not vary based on variables such as other trips taken - it always charges the same amount (or the driver inputs the fare). As such, this model has limited capability and is most commonly used for pilots and proof-of-concepts.

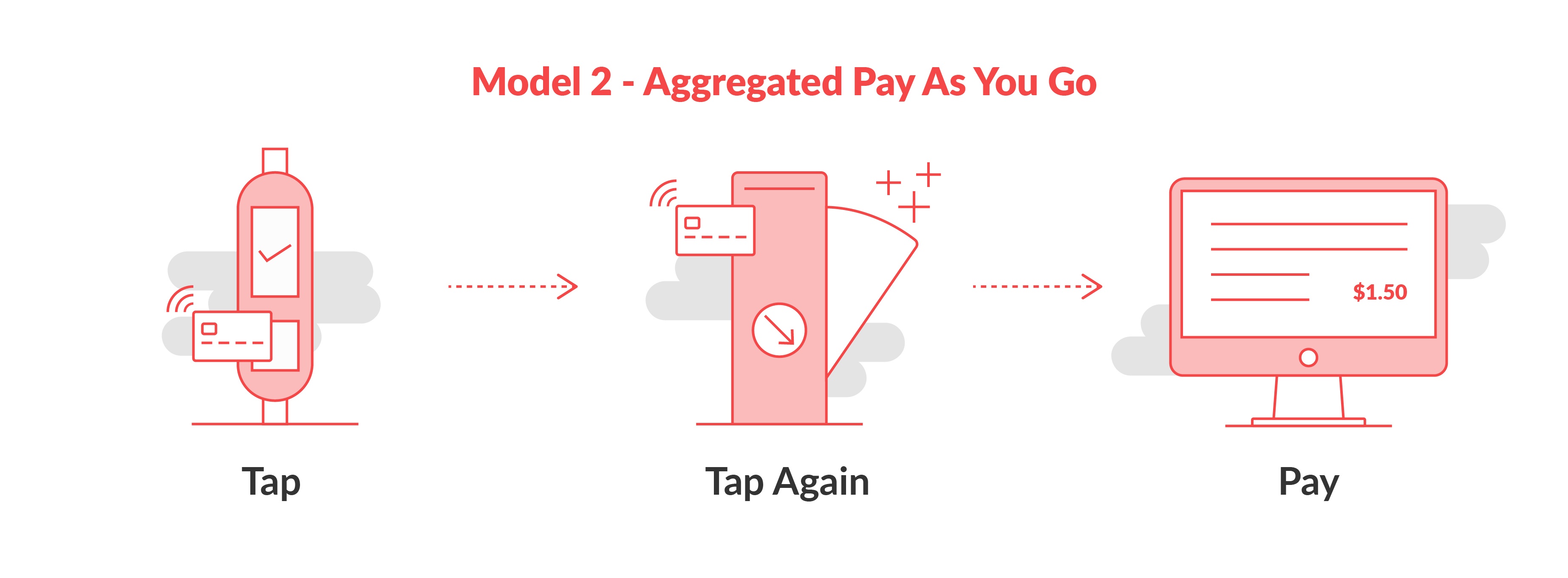

Model 2: Aggregated - Pay as You Go Model or MTT

This model allows for more complex pricing and multimodal journeys. It can combine multiple journeys and modes of transport into a daily charge based on where the taps took place and can then add in additional capping as passengers "earn" weekly or monthly passes etc. In the case of monthly capping, for example, passengers tap around the transport network for a number of days until they reach the monthly pass value; once this is hit the system stops charging the passenger until the next month comes around.

This system records where passengers enter and (for distance-based fares) exit the network and can take into account the modes and zones taps are recorded in. This system runs off an Account-Based back office which means passengers do not need to buy a ticket before travel, they simply use their secure token (in this case a cEMV card) and are charged periodically (as defined by the scheme rules).

Card Scheme Rules

When Masabi operates a contactless system Justride’s (Masabi’s platform) EMV rules will decide whether to capture money immediately, or hold the charges open to aggregate multiple journeys into a single payment, which reduces the effective cost per transaction (because there is a fixed fee per transaction when it is cleared). This is primarily driven by card scheme rules (which vary between schemes), but will also factor in passenger-specific risk and agency preferences.

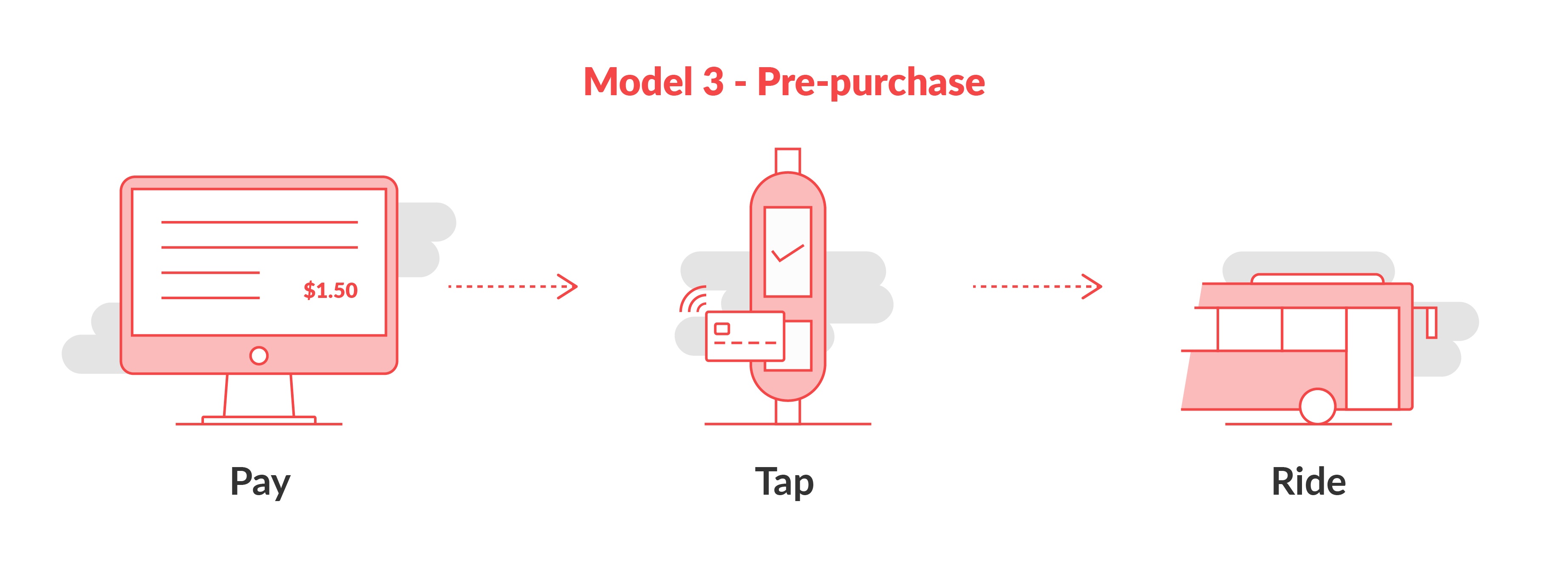

Model 3: Pre-purchase

This model is suitable for long distance travel or agencies not looking to implement fare capping across all their fare types, but still wanting an Account-Based system and the benefits of passengers bringing their own ticket. It requires the customer to purchase a ticket before they travel online and link it to their account, which is associated with their cEMV card. Customers then use their contactless card as their ticket to travel.

EMV Ticketing Model Comparison Table

Below we have pulled together an EMV model comparison table showing the differences between the different approaches:

The Benefits of Contactless EMV Ticketing

cEMV cards represent a secure "open-loop" token which has been proven to work well to enable passengers to simply tap and ride public transport. Using cEMV cards offers many advantages to passengers due to the unique fact that they are both a secure token and authenticatable payment method in one. They are also already in passengers' pockets and can be used across any transport system set up to accept “contactless” payments without needing to set up an account, which is a great way of enabling people to travel with minimal friction. This can also be enabled on people’s smartphones and smart devices through services such as Apple Pay and Google Pay.

Contactless Ticketing Benefit 1: Frictionless tap and ride experiences

Contactless EMV is unique in the fact that there is no need to purchase a ticket before traveling, set up an account, or download an app. Simply tap a contactless credit/debit card and ride.

Contactless Ticketing Benefit 2: Best possible fare

With a Model 2 or MTT contactless ticketing system passengers just tap and ride. Because the system works by associating taps to a rider’s account and then calculating the fare based on those taps, agencies can then implement rules enabling best-priced fares for riders using fare-capping.

Contactless Ticketing Benefit 3: Fare model optionality and flexibility

Contactless (Model 2 and 3) systems enable the rapid implementation of new fares and transfer rules extremely quickly from the central back office.

Contactless Ticketing Benefit 4: Easy to maintain – fare engine in the back office not on the reader.

Fare calculations are processed in the back office instead of on the validation unit. This means the system is easier to maintain as it is a single back office instead of a network of locally-hosted devices each of which require tariff maintenance.

Contactless Ticketing Benefit 5: Dematerialization - Covid-Safe

Contactless systems help reduce the need for transport agencies and operators to issue proprietors tickets to passengers in the form of paper passes or plastic cards. This saves money and also means agencies can reduce their use and reliance on bespoke hardware used to issue tickets. This is also particularly useful for making travel as safe as possible during the Covid-19 pandemic as it avoids contact with tickets and ticketing infrastructure.

Contactless Ticketing Benefit 6: Reduced cash-handling - Covid-Safe

Contactless systems also help reduce the cost of cash handling, which can be significant, and helps agencies speed up boarding and journey times by being able to reduce cash purchases, or remove them from buses entirely. Similarly, this is also particularly useful for making travel as safe as possible during the Covid-19 pandemic as it avoids the exchange of cash between people, or using ticketing infrastructure.

For more information download our Contactless Ticketing (cEMV) Look Book.

What is Account-Based Ticketing?

Account-Based Ticketing is defined by the Smartcard Alliance as: “The transit fare collection system architecture that uses the back office system to apply relevant business rules, determine the fare, and settle the transaction.

Essentially right to travel is managed by the central back office and the "ticket" the passenger has acts as a "token" or proof of the right to travel and identifier of a customer’s account - hence, Account-Based. The back office stores the tokens usage patterns and also settles the transaction (based on usage). As such, the back office is the primary source of truth, unlike in a Card Centric system where it is the card.

Because of this, passengers are able to use what they have in their pocket to travel, be it a cEMV contactless bank card, smartcard, phone or a smart wearable and the payment will link with their "account" residing in the back office. This means passengers no longer need to buy a ticket or understand fares to travel, safe in the knowledge they will be charged "best fare" for their journey.

Account-Based Ticketing systems are also better placed to take advantage of the advances in technology to run and scale more efficiently, with the back-offices often being managed from the "Cloud".

For the transport provider the benefits are significant. With legacy Card Centric systems, transport providers have to act as a local currency, exchanging cash or card payment for a ticket to travel. These paper or smartcard systems are expensive to install and expensive to operate and update.

Account Based Ticketing allows transport providers to move to "open loop" systems (open tokens such as contactless bank cards) and away from the cost of issuing physical ticket media and the cost of handling cash.

What is Open-Loop Ticketing?

The term "Open Loop" references the fact that the ticketing system leverages existing open "tokens'' and processes that are not proprietary to the transport network in question. These tokens also work outside of the transport system, hence "Open". The main "Open Loop" tokens are a cEMV contactless bank card or cEMV payments made through a mobile device.

For an "Open Loop" system to work there needs to be a token available within the transport network’s ridership which is ubiquitous enough that a "token" does not need to be issued by the transport provider (or media issuance is kept to an absolute minimum).

For an "Open Loop" system to work there needs to be a token available within the transport network’s ridership which is ubiquitous enough that a "token" does not need to be issued by the transport provider (or media issuance is kept to an absolute minimum).

Two devices well suited to be used as "tokens" in cities today are smartphones and contactless bank cards (contactless EMV).

Open Loop tokens are typically paired with an Account-Based back-office system to calculate the correct fare for a rider based on the travel patterns captured by the token’s use within the transit network.

Moving beyond contactless EMV and smartphone devices, an Account-Based Ticketing system can also support the ability for passengers to use other "tokens" to travel such as a library, student or national identity card, mobile barcode or smartcard.

Contactless Ticketing: Bespoke Ticketing Systems Vs Fare Payments-as-a-Service

When selecting how to implement a contactless ticketing system - cities, agencies and operators have a choice. They can deploy a bespoke solution from an AFC supplier. However, because these systems are bespoke single instance solutions they come with inherent problems. They often take years to go live with a significant build risk, are expensive to build, maintain and update and do not update with new features and functionality without additional spending and resources, so often "decay" for years.

Or

Cities, agencies and operators can opt for a Fare Payments-as-a-Service approach using a multi-tenant fare payments platform. When using a platform, once a capability is built it can be deployed extremely quickly for every agency who needs it as everyone is using the same platform and code. It's far more cost-effective to deploy, maintain and update because costs are amortised across all users of the platform and everyone using the platform benefits from constantly improving features and functionality, as one update benefits all users.

Justride Contactless Ticketing Capabilities

Masabi's Justride platform has an Account-Based Ticketing back office (we enable secure tokens to be tapped and calculate the fare based on those taps) meaning passengers no longer need to buy a ticket in advance to travel on public transport (Model 2 or MTT).

Based on a Fare Payments-as-a-Service delivery model and using our market-leading platform (Justride), Masabi can deliver contactless ticketing for a fraction of the price of legacy providers. Transport authorities no longer need to spend tens or hundreds of millions of pounds/dollars to bring "contactless" and Account-Based Ticketing to their passengers.

If you would like to learn more about what we are able to offer in the cEMV "contactless" space, or if you are interested in Account-Based Ticketing solutions using mobile phones, paper barcodes or smarcards, please get in contact with us.

Further reading: